cryptocurrency market analysis april 2025

- Latest cryptocurrency news april 2025

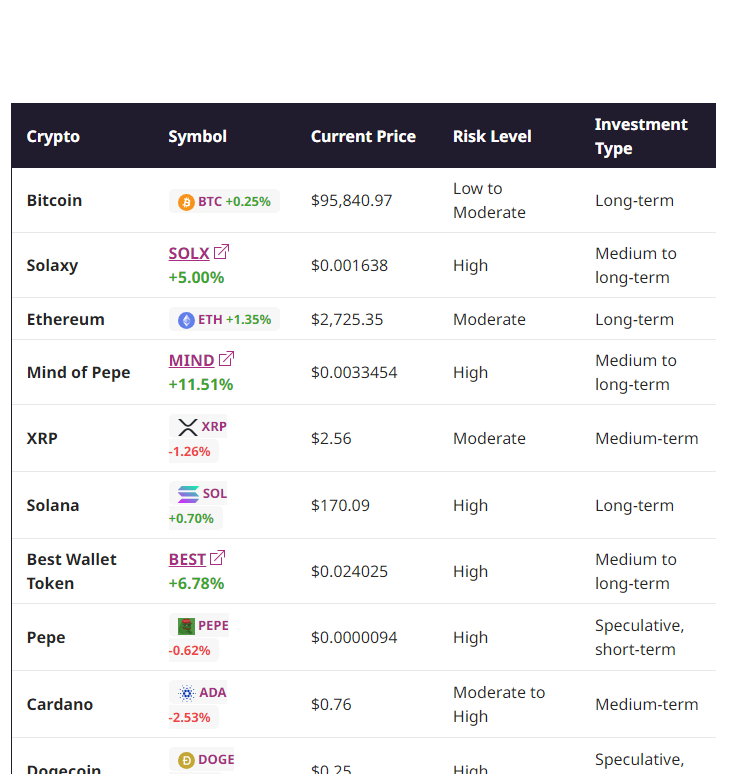

- Best cryptocurrency to buy april 2025

- Best cryptocurrency to buy now april 2025

Cryptocurrency market analysis april 2025

Superintelligence Alliance (ASI -0.08%) is a merger of three popular AI cryptos: SingularityNET, Fetch.ai, and Ocean Protocol. All three projects were interesting players in the AI space, and two (SingularityNET and Fetch https://westpacificgirlscouts.com/.ai) have been on this list before.

It’s a unique service, and demand will likely grow as more media companies need to convert text to images. The growing popularity of AI could also be good for Render, as training AI models requires considerable GPU power.

Created by some of the same founders as Ripple, a digital technology and payment processing company, XRP can be used on that network to facilitate exchanges of different currency types, including fiat currencies and other major cryptocurrencies.

That hasn’t translated into sizable returns so far, especially compared to what market leader Bitcoin has been doing. Ethereum’s performance hasn’t impressed investors, and some institutional investors have decided to sell.

Latest cryptocurrency news april 2025

Bitcoin purchases by public companies have been one consistent source of demand. Strategy (formerly MicroStrategy), which pioneered corporate Bitcoin investing, purchased another 25k Bitcoin (~$2.4bn) during April. Strategy now holds roughly 3% of the circulating supply valued at more than $50bn. Separately, a consortium including Tether, Bitfinex, Softbank, and Cantor Fitzgerald announced the creation of Twenty One Capital, a new company initially capitalized with 42,000 Bitcoin. At that size Twenty One Capital would have the third-largest Bitcoin portfolio among public companies, after Strategy and Bitcoin miner MARA. The company will go public through a SPAC (special-purpose acquisition company), which currently trades as Cantor Equity Partners (ticker: CEP).

The gambling process on traditional online platforms requires users to complete extensive verification steps and approvals. However, users can make instant transactions through crypto gambling sites using Bitcoin, Ethereum, and other alternative digital assets. The worldwide popularity of these sites stems from their quick and easy transactions.

With the bull market getting ready for recovery, a number of cryptos are showing signs of bullish momentum building up as we anticipate a bullish phase in the next few days or weeks.Here are a number of cryptos to watch in April, with the potential to realise huge profits.

The key level to watch for PEPE is $0.00000633, which represents PEPE’s 38.2% Fibonacci level acting as a a critical support and potential rebound point. A successful rebound from this level could confirm a lasting bottom. The meme coin’s performance will largely depend on market sentiment and social media trends.

The election of Donald Trump has already provided a significant boost to the cryptocurrency market, with his administration appointing crypto-friendly leaders to key positions, including Vice President JD Vance, National Security Advisor Michael Waltz, Commerce Secretary Howard Lutnick, Treasury Secretary Scott Bessent, SEC Chairman Paul Atkins, FDIC Chair Jelena McWilliams, and HHS Secretary RFK Jr, among others.

Best cryptocurrency to buy april 2025

Based on research and analysis, the cryptocurrency market in April 2025 presents diverse opportunities. Projects like Qubetics, Binance Coin, Sonic, Bitcoin Cash, Bittensor, Chainlink, and Monero each offer unique value propositions, catering to various aspects of the digital economy.

The recent price surge, supported by increased volume, indicates bullish momentum. Last week’s technical movements saw $ETH fill an imbalance zone and successfully test critical support levels, reinforcing buyer confidence.

Some reports suggest a significant downtrend in DEX activity and TVL, highlighting concerns about Solana’s long-term stability. However, the possibility of a Solana ETF and the resilience shown by its ecosystem offer some reasons for optimism.

Created by an XRP co-founder, Stellar operates with a similar technical architecture but focuses on broader financial inclusion rather than purely institutional implementation. Its key objectives include providing banking-like services to the approximately 1.4 billion adults globally without financial access.

Based on research and analysis, the cryptocurrency market in April 2025 presents diverse opportunities. Projects like Qubetics, Binance Coin, Sonic, Bitcoin Cash, Bittensor, Chainlink, and Monero each offer unique value propositions, catering to various aspects of the digital economy.

The recent price surge, supported by increased volume, indicates bullish momentum. Last week’s technical movements saw $ETH fill an imbalance zone and successfully test critical support levels, reinforcing buyer confidence.

Best cryptocurrency to buy now april 2025

The disjointed nature of blockchain ecosystems has long presented a significant roadblock to mainstream adoption. Each crypto network typically requires dedicated applications for basic use — a cumbersome user experience that limits broader participation.

Regulatory clarity and market acceptance will be crucial for XRP to reach the higher end of this spectrum. The expected positive resolution of the battle between Ripple and the SEC is clearly positively impact its trajectory.

Stellar is bridging the gap between traditional finance and blockchain, making international remittances faster, cheaper, and more accessible than ever. With its partnership with MoneyGram and integration with major fintech firms, Stellar is quickly becoming a leader in global payments.

Breaking above the Fibonacci level of $14.04 could signal a bullish reversal in $DOT, with significant growth potential. Support levels around $3.55 will be important for maintaining a positive trend.

Bitcoin remains the undisputed king of crypto. With the increasing institutional adoption and Trump’s executive order to establish a strategic bitcoin reserve, bitcoin is more than just a speculative investment. This regulatory clarity could unlock a wave of institutional capital, driving bitcoin’s demand and long-term value.